Types of securities in Switzerland

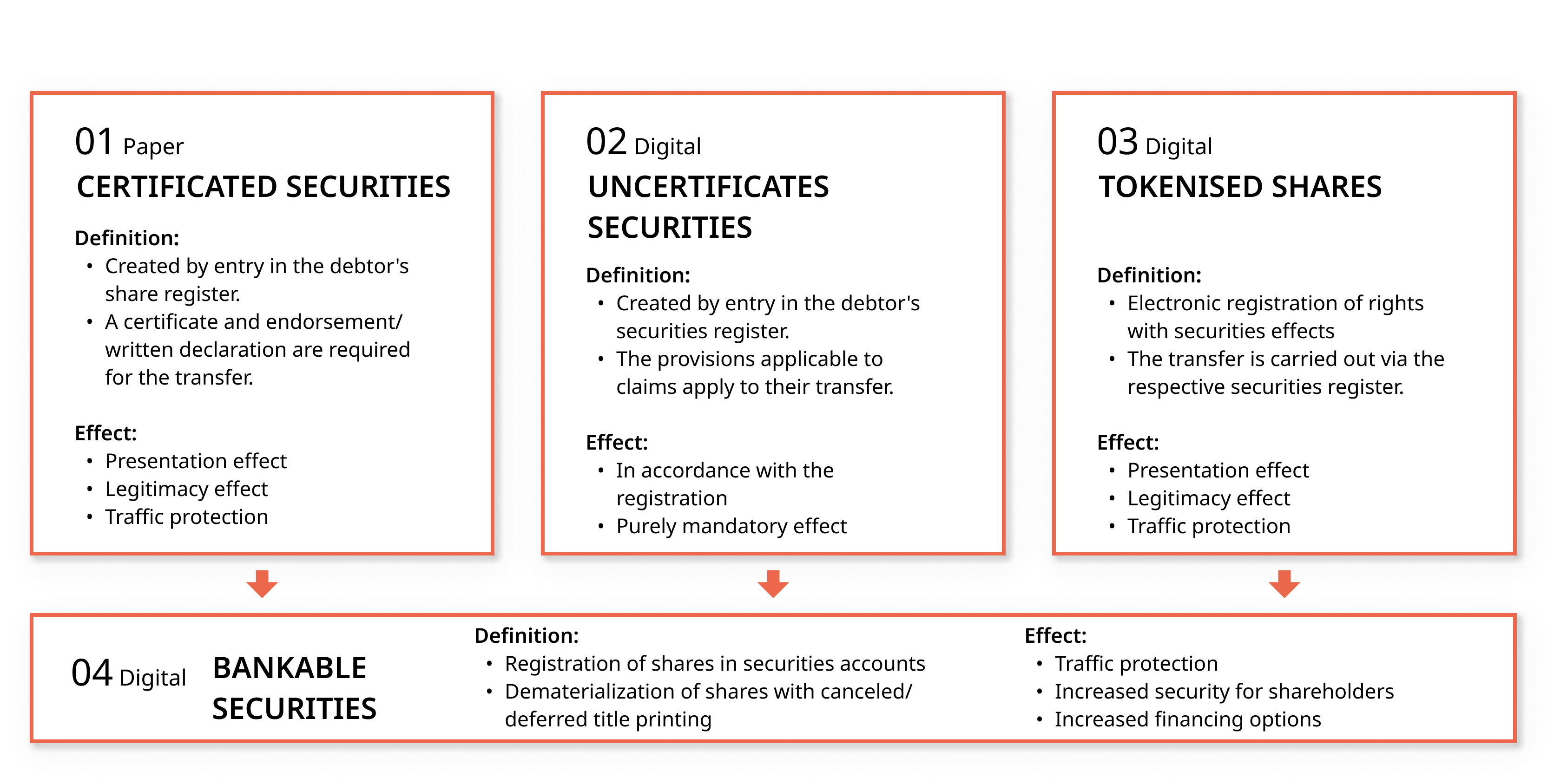

The Swiss Code of Obligations provides for three central forms, or “wrappers”, in which shares can be structured: Security certificates, uncertificated securities and tokenized shares. Additionally, each type of security can be packaged as a Bankable Security. While all these options legally secure a shareholder’s ownership claim, they differ in terms of form, custody, transferability and capital market suitability.

A security certificate is a deed that documents the ownership claim in certificated form. An Uncertificated Security is a non-certificated membership right that is entered in the share register of the issuer. A Tokenized Share, with the revision of the Swiss Code of Obligations and the introduction of the so-called DLT bill, represents a digital further development of the securities. They are based on entry in a decentrally and electronically maintained register that meets the requirements of forgery-resistance, transparency, and integrity. In practice, blockchain technologies are mostly used for this purpose. By contrast, a bankable security is a security that, under the Federal Act on Intermediated Securities (FISA), is held in custody by an intermediary, such as a bank, in a securities account. These differences are of considerable practical relevance for companies planning an IPO in Switzerland, seeking to obtain their own ISIN or intending to carry out an exit.

Historical development and legal framework of security types in Switzerland

Certificated Securities

Historically, security certificates were the starting point for share trading. Elaborately designed deeds served as proof of ownership for shareholders. While these certificates granted shareholders immediate ownership rights, they were not subject to the company’s control and were also associated with risks. The loss or theft of an ownership certificate, as well as the resulting difficulty of transfer, required considerable administrative effort. Lost deeds had to be declared void through a complex and time-consuming legal process. Additionally, the costs of printing, storage and transport were considerable.

Uncertificated Securities

With the advent of digital administration, so-called uncertificated securities were introduced. The physical deed became obsolete, as ownership relations were documented exclusively in the company’s share register. Legally, uncertificated securities are defined in accordance with Art. 973c CO as non-certificated membership rights entered in the share register of the issuer. This implies a shift of custody from the shareholders back to the company. The advantages of these uncertificated securities therefore include significant cost reduction, simplified transferability and the elimination of the risk of physical loss.

Bankable Securities

The next stage of development came with the introduction of the Federal Act on Intermediated Securities (FISA). This measure enabled Uncertificated Securities to be held as Bankable Securities in a book-entry system. In practice, these securities are booked as bank deposits and held in central custody. Consequently, custody shifts once again, this time from the company to a financial intermediary. This offers shareholders increased security, since administration is subject to the strict regulatory requirements of the Swiss Financial Market Supervisory Authority (FINMA). Another factor that makes Bankable Securities attractive is their international tradability. They are assigned an International Securities Identification Number (ISIN) and can be used as collateral for credit. For companies seeking an IPO in Switzerland or a listing on an international stock exchange, Bankable Securities are almost mandatory, since they are a prerequisite for trading on regulated markets.

Tokenized Shares

The most recent innovation came in 2021 with the introduction of the DLT bill: the tokenised share. This occurs when the issuer enters its shares into an electronic register that meets the criteria set out in the Swiss Code of Obligations. Shares can then be transferred directly through the digital register, rather than via an assignment declaration or an entry in the physical share register. This digitises the share, enabling it to be transferred directly within the system from one shareholder to another. Tokenized Shares are particularly useful for targeting investors with an interest in cryptocurrency. However, the concept of tokenised shares has so far met with little acceptance among institutional investors due to legal uncertainties.

Overview - Types of securities

Practical considerations for companies

Uncertificated Securities: The foundation for SME’s

For smaller stock corporations without a focus on the capital market, uncertificated securities generally represent the most efficient form of share custody. They minimise costs, simplify administration and give the company full control over the share register. Transaction processing remains internal and does not require banking intermediaries.

Tokenized Shares: For crypto-affine investors

For smaller stock corporations with crypto-affine investors, tokenised shares may be the most suitable option. Companies aiming to attract many small investors, in particular, benefit from simple digital transferability in the case of frequently expected secondary transactions. However, for companies seeking a traditional IPO or wishing to attract large institutional investors, tokenised shares are currently less suitable. In these cases, Bankable Securities continue to set the standard as they are internationally recognised, ISIN-eligible and compatible with global trading and custody structures.

Bankable Shares: The Standard for IPO’s

Bankable Securities offer clear strategic advantages for larger corporations or those considering an IPO. As well as being internationally tradable, they allow the use of well-established settlement systems, help to ensure compliance with regulatory requirements and boost the confidence of institutional investors. Another potential benefit for shareholders is the ability to use Bankable Securities as collateral for a bank deposit. This can be particularly beneficial for founders who have many assets but limited liquidity, such as real estate.

Physical Certificates: Symbolic purposes

From a practical perspective, Security Certificates are rarely meaningful today. Their use is limited to special cases such as anniversary deeds, collector’s items or symbolic purposes at company formations. They no longer offer any significant advantages for operational processing and capital market integration.

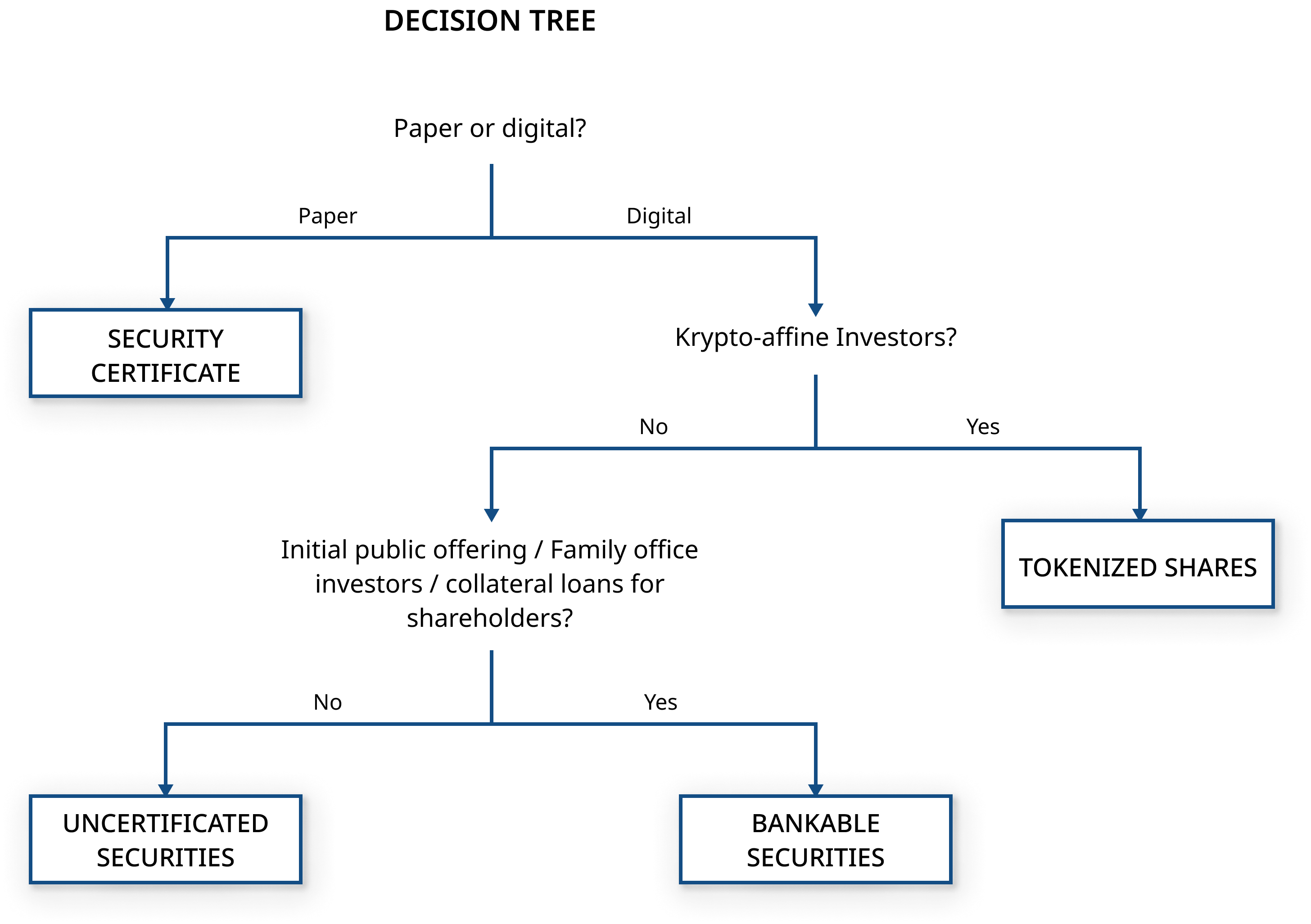

Which type of securitiy is right for my company?

To help you choose the right type of share custody, we have created a decision tree:

Conclusion

The choice between a security certificate, uncertificated security, tokenised share and bankable security should not be justified solely from a legal perspective, but must above all be considered strategically and operationally. For SMEs, uncertificated securities are a cost-efficient and administratively straightforward solution, whereas bankable securities are almost indispensable for listed companies and IPO candidates. They lay the technical and legal groundwork for inclusion in trading systems, boost investor appeal, and unlock financing opportunities through share pledging.

Companies considering an IPO in Switzerland should examine early on whether their share structure meets capital market requirements. Converting to bankable securities requires legal adjustments and the involvement of a custodian bank as paying agent. Careful design of the transition from uncertificated securities to bankable securities can be crucial in optimising capital raising and maximising corporate value in the context of an IPO.

It becomes evident that the structuring of shares is not merely a formal aspect of corporate law but must be regarded as an essential component of corporate strategy. This must be taken into account in all forms of enterprises, from small family businesses to globally operating public companies.